PharmaShares Exchange (PSE) provides a private marketplace for accredited investors and qualified institutional buyers to take long or short positions in individual commercial drugs, without investing in the company manufacturing or distributing the product.

PSE offers members the ability to take a bullish or bearish position in a defined commercial pharmaceutical product (Humira, for example) without taking any exposure to the stock of the publicly traded parent (Abbvie, in the Humira example). The public reporting of the quarterly net sales of commercial healthcare assets (pharmaceutical products and divisions) will serve as the defining parameter of the settlement of contracts on PSE. A position can be defined as net product sales within a defined region: Worldwide, United States, International, Emerging Markets, or other region.

The ability of PSE members to take positions of net sale of pharmaceutical (or other products) within specific regions will depend on the scope of public financial reporting by the marketing entity. In certain cases, multiple pharmaceutical companies will co-market a commercial product. In those cases, each company involved in the co-marketing will separately report its share of the allocated worldwide sales, which will serve as the basis for PSE contracts for the entity.

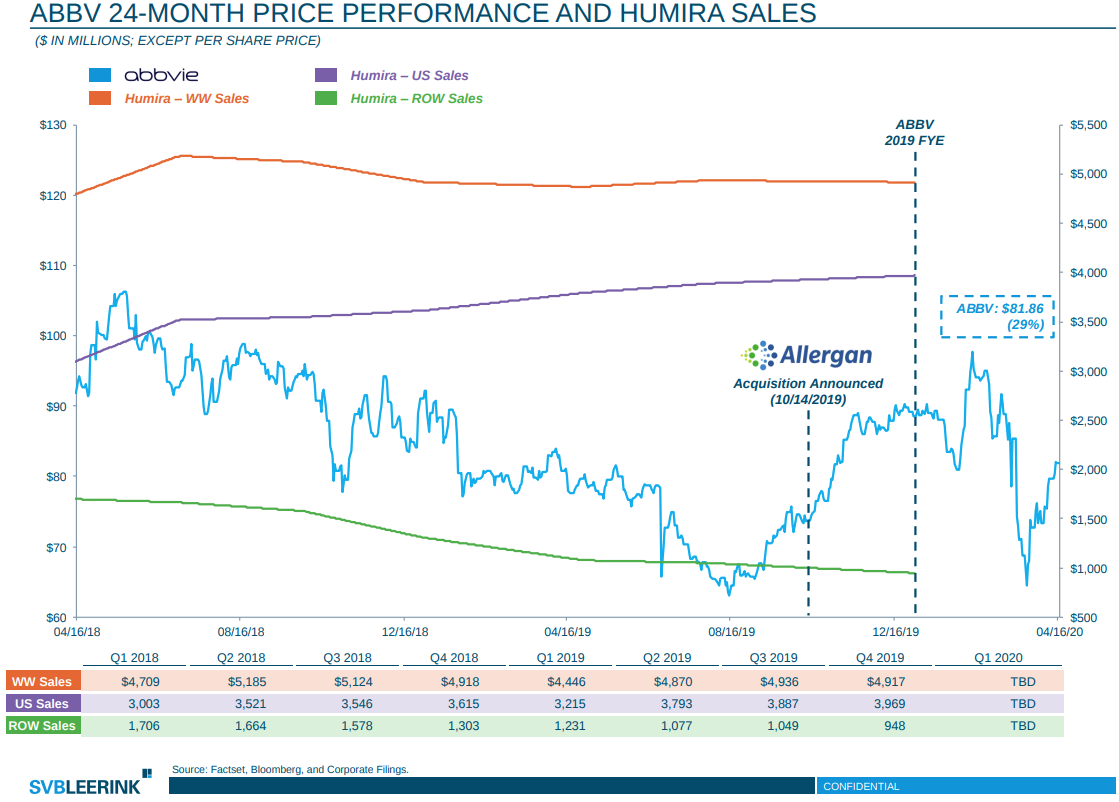

The following graph illustrates the challenge for healthcare investors: separating the performance of material pharmaceutical products from overall corporate decisions of large cap pharmaceutical companies. This graph illustrates the relative performance over [2019] of Abbvie stock, Humira Worldwide net sales, Humira US net sales and Humira International net sales. Material corporate events undertaken by Abbvie (such as the acquisition of Allergan for $[63]bn) and material events associated with Humira (marketing in therapeutic areas of plaque psoriasis and Crohn’s disease) may result in much different results of the earnings and stock returns of Abbvie corporation from Humira.

The loss of exclusivity of a blockbuster commercial pharmaceutical product may lead a company to engage in M&A efforts to import additional commercial assets and/or a pipeline of products onto the balance sheet. Premiums paid for such M&A transactions may be value destructive to the shareholders an acquiring company. Meanwhile, new indications of existing products may products superior returns when compared to the publicly traded stock. Investors now have a choice — PSE provides the forum to find a contract counterparty for the desired, direct economic position in a specific healthcare product.

In addition to individual pharmaceutical drug exposure, members of PharmaShares Exchange can take positions in divisions of a healthcare company. For example, a PSE member may not be interested in JNJ stock, but can execute a contract based upon the projected net sales of Johnson & Johnson’s Total Phamaceutical Division. Or, as another example, exposure to Medtronic‘s Restorative Therapies Group may be executed instead of purchasing Medtronic common stock.

The PharmaShares Exchange does not, and will not, hold any equity in (or contract rights with) the public companies marketing the pharmaceutical products on which PSE members track changes of net sales for settlement. Rather, it is the direct interaction between PSE members that define the settlement terms of their contracts.

Contracts may be for a quarter, half year, annual or multi-year; and the contracts may be for the current of following period, or may be established on a “forward start” basis for future periods. These terms are based upon the decisions of PSE members executing contracts.

Contracting members may negotiated for pre-paid or post-paid contract settlement. Members can be assured of settlement certainty of their counterparty based upon standard letter of credit posting with a lending institutional affiliated with PSE.